Everything To Learn About Equity Release Mortgages

Everything To Learn About Equity Release Mortgages

Blog Article

The Necessary Factors to Take Into Consideration Before Using for Equity Release Mortgages

Before requesting equity Release mortgages, individuals need to carefully consider a number of crucial factors. Understanding the effects on their monetary situation is essential. This includes assessing current income, prospective future expenses, and the impact on inheritance. In addition, checking out different item types and connected expenses is important. As one browses these intricacies, it's important to evaluate psychological ties to residential property against useful economic demands. What other factors to consider might influence this considerable choice?

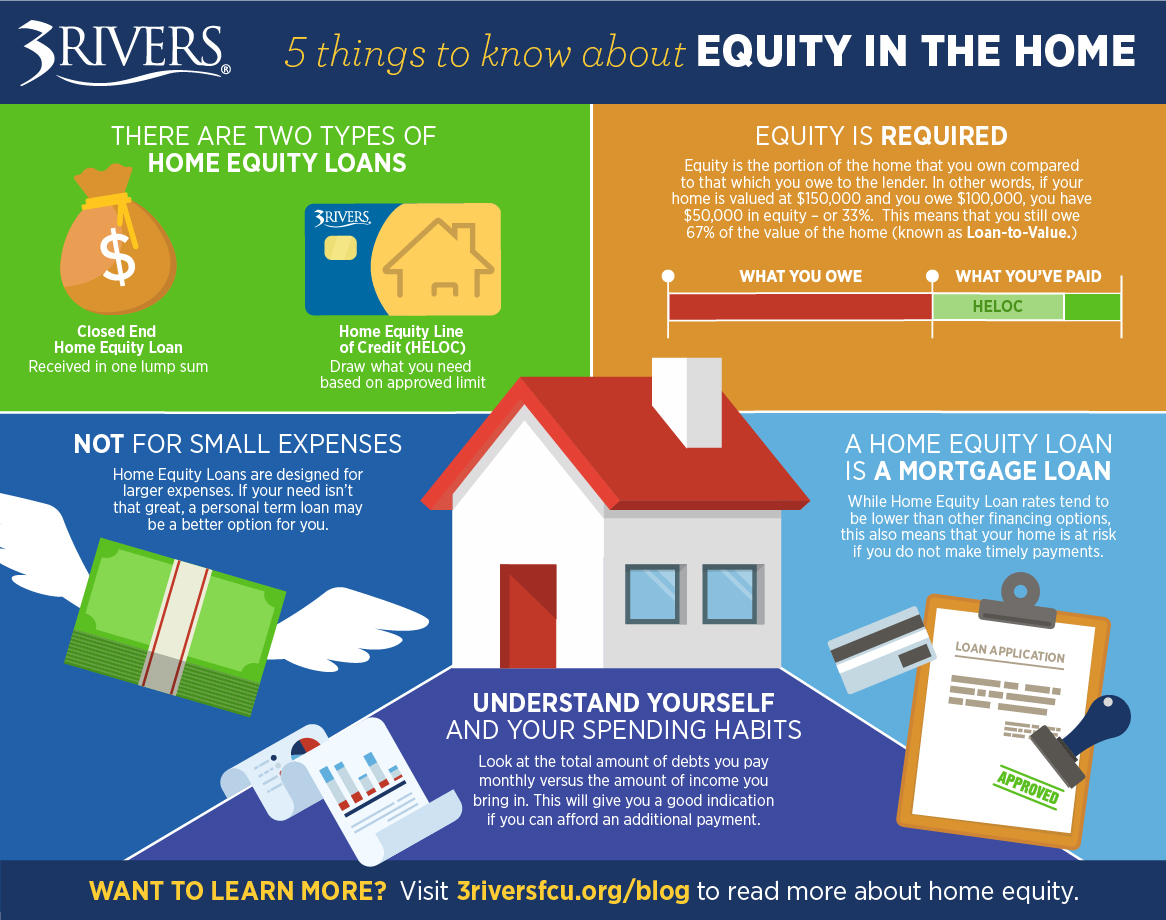

Comprehending Equity Release: What It Is and Just how It Works

Equity Release allows home owners, usually those aged 55 and over, to access the wealth locked up in their building without requiring to market it. This financial service allows individuals to expose a part of their home's value, offering cash money that can be made use of for different functions, such as home enhancements, debt payment, or improving retirement revenue. There are two main types of equity Release products: life time home loans and home reversion plans. With a life time mortgage, property owners maintain ownership while borrowing versus the home, paying off the finance and interest upon fatality or moving into long-term care. Conversely, home reversion includes selling a share of the residential or commercial property for a lump amount, allowing the homeowner to continue to be in the home till death. It is important for prospective candidates to recognize the effects of equity Release, including the effect on inheritance and prospective charges connected with the arrangements.

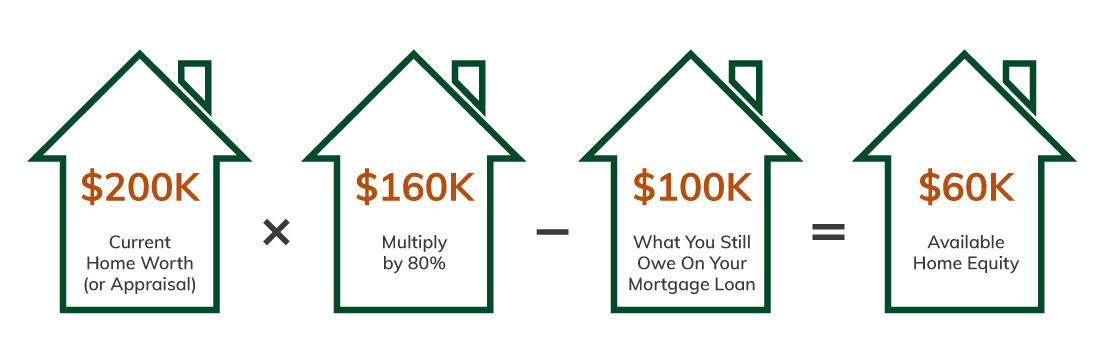

Assessing Your Financial Circumstance and Future Demands

How can a house owner efficiently assess their economic scenario and future requirements prior to taking into consideration equity Release? First, they must conduct a comprehensive analysis of their existing revenue, expenses, and cost savings. This includes evaluating month-to-month expenses, existing financial obligations, and any type of potential revenue resources, such as pension plans or investments. Comprehending cash flow can highlight whether equity Release is necessary for financial stability.Next, property owners should consider their future requirements. This involves preparing for possible medical care expenses, way of life adjustments, and any major expenditures that may occur in retirement. Establishing a clear budget can assist in determining just how much equity may be needed.Additionally, seeking advice from a monetary consultant can offer understandings into the long-term ramifications of equity Release. They can aid in lining up the homeowner's financial situation with their future purposes, ensuring that any decision made is educated and aligned with their general economic well-being.

The Influence on Inheritance and Household Financial Resources

The choice to make use of equity Release mortgages can considerably influence family finances and inheritance planning. Individuals need to consider the effects of inheritance tax obligation and exactly how equity distribution among successors may change consequently. These variables can affect not only the economic legacy left but additionally the relationships amongst household members.

Estate Tax Implications

Many house owners think about equity Release home loans as a way to supplement retired life income, they might accidentally impact inheritance tax responsibilities, which can substantially influence family members financial resources. When homeowners Release equity from their property, the quantity obtained plus passion collects, reducing the value of the estate left to beneficiaries. This could lead to a higher estate tax costs if the estate goes beyond the tax obligation threshold. Furthermore, any kind of continuing to be equity might be deemed as part of the estate, complicating the economic landscape for beneficiaries. Families need to be aware that the decision to accessibility equity can have long-term effects, possibly reducing the inheritance planned for liked ones. As a result, cautious factor to consider of the implications is necessary before waging equity Release.

Household Financial Preparation

While thinking about equity Release home mortgages, families should acknowledge the significant impact these economic choices can carry inheritance and overall household funds. By accessing home equity, homeowners may lower the value of their estate, potentially impacting the inheritance entrusted to successors. This can bring about feelings of uncertainty or dispute among member of the family regarding future monetary expectations. Additionally, the costs related to equity Release, such as rate of interest and fees, can collect, lessening the continuing to be possessions offered for inheritance. It is important for households to participate in open discussions regarding these concerns, ensuring that all members understand the effects of equity Release on their lasting economic landscape. Thoughtful planning is important to balance prompt monetary demands with future family members traditions.

Equity Distribution Among Successors

Equity circulation among heirs can considerably change the financial landscape of a family, especially when equity Release mortgages are involved. When a homeowner determines to Release equity, the funds removed might reduce the estate's total worth, affecting what successors obtain. This decrease can result in disagreements among household participants, specifically if assumptions pertaining to inheritance vary. The responsibilities connected to the equity Release, such as settlement terms and passion buildup, can make complex economic preparation for successors. Family members must think about how these factors affect their long-term economic wellness and partnerships. Open up discussions concerning equity Release choices and their ramifications can help ensure a more clear understanding of inheritance dynamics and mitigate potential problems among beneficiaries.

Discovering Different Sorts Of Equity Release Products

When taking into consideration equity Release alternatives, people can select from several distinct products, each customized to different monetary requirements and situations. One of the most usual types include lifetime home loans and home reversion plans.Lifetime home mortgages permit house owners to obtain against their home value while keeping possession. The finance, along with built up passion, is paid back upon the property owner's death or when they relocate into lasting care.In contrast, home reversion intends include marketing a part of the home to a company in exchange for a round figure or normal repayments. The property owner can proceed staying in the building rent-free until fatality or relocation.Additionally, some items offer adaptable functions, making it possible for customers to take out funds as required. Each item brings distinct benefits and factors to consider, making it crucial for people to analyze their monetary goals and long-lasting ramifications prior to picking the most appropriate equity Release alternative.

The Role of Rate Of Interest Rates and Charges

Picking the right equity Release product entails an understanding of various economic elements, consisting of rate of interest prices and connected costs. Interest rates can greatly impact the general expense of the equity Release strategy, as they identify exactly how much the consumer will owe gradually. Dealt with rates offer predictability, while variable prices can change, impacting long-lasting economic planning.Additionally, borrowers must know any type of in advance fees, such as plan or appraisal costs, which can contribute to the initial cost of the home mortgage. Ongoing fees, including annual administration charges, can likewise collect over the regard to the loan, potentially reducing the equity offered in the property.Understanding these expenses is crucial for debtors to review the total financial dedication and assure the equity Release product straightens with their monetary objectives. Careful factor to consider of interest prices and fees can help people make informed choices that suit their situations.

Seeking Professional Suggestions: Why It is essential

Exactly how can people browse the intricacies of equity Release mortgages successfully? Looking for specialist guidance is a necessary step in this process. Financial experts and home loan brokers possess specialized expertise that can illuminate the complexities of equity Release items. They can supply customized advice based upon an individual's special monetary circumstance, making sure informed decision-making. Specialists can assist clarify conditions, recognize possible mistakes, and highlight the long-lasting effects of becoming part of an equity Release agreement. In addition, they can help in comparing different alternatives, making certain that individuals pick a plan that lines up with their needs and goals.

Examining Alternatives to Equity Release Mortgages

When taking into consideration equity Release home loans, individuals may locate it advantageous to explore other financing options that could much better suit their demands. This includes reviewing the possibility of scaling down to access capital while keeping monetary stability. A thorough evaluation of these alternatives can cause even more enlightened decisions relating to one's monetary future.

Other Financing Options

Downsizing Considerations

Downsizing offers a viable alternative for individuals thinking about equity Release home loans, specifically for those aiming to access the worth of their home without incurring added financial debt. By offering their existing home and buying a smaller sized, extra inexpensive residential or commercial property, home owners can Release considerable equity while lowering living expenditures. This option not just eases economic concerns yet also simplifies upkeep obligations connected with bigger homes. Additionally, scaling down might supply an opportunity to relocate to a preferred location or a community tailored to their way of life requires. It is important for people to review the psychological facets of leaving a veteran residence, as well as the potential prices involved in relocating. Mindful consideration of these factors can bring about an extra enjoyable financial decision.

Frequently Asked Questions

Can I Still Relocate House After Obtaining Equity Release?

The individual can still move residence after taking out equity Release, yet they must guarantee the brand-new residential property fulfills the lending institution's criteria (equity release mortgages). Furthermore, they might need to pay off the finance upon relocating

What Takes place if My Property Value Lowers?

The homeowner might face reduced equity if a building's value lowers after taking out equity Release. Nevertheless, several plans use a no-negative-equity assurance, making sure that payment quantities do not exceed the home's worth at sale.

Exist Age Restrictions for Equity Release Applicants?

Age restrictions for equity Release candidates typically need individuals to be a minimum of 55 or 60 years of ages, Continue relying on the company. These requirements assure that applicants are most likely to have sufficient equity in their residential property.

Will Equity Release Impact My Eligibility for State Advantages?

Equity Release can possibly influence qualification for state advantages, as the released funds may be considered revenue or resources (equity release mortgages). People ought to seek advice from financial advisors to recognize how equity Release affects their certain advantage privileges

Can I Settle the Equity Release Home Mortgage Early Without Penalties?

Final thought

In summary, navigating with the complexities of equity Release mortgages calls for cautious consideration of various aspects, consisting of economic scenarios, future demands, and the potential influence on inheritance. Recognizing the different product options, connected expenses, and the value of professional assistance is essential for making notified choices. By completely assessing alternatives and balancing psychological add-ons to one's home with functional economic demands, individuals can identify the most suitable method to accessing their home equity sensibly (equity release mortgages). Establishing a clear spending plan can aid in identifying just how much equity may be needed.Additionally, consulting with a financial advisor can give insights into the lasting implications of equity Release. Equity distribution amongst beneficiaries can considerably modify the financial landscape of a household, particularly when equity Release home loans are entailed. Recurring costs, consisting of annual management costs, can also collect over the term of the lending, possibly minimizing the equity offered in the property.Understanding these expenses is crucial for customers to assess the total financial dedication and ensure the equity Release product aligns with their monetary goals. If a home's value lowers after taking out equity Release, the property owner may face decreased equity. Equity Release can potentially affect eligibility Visit Your URL for state benefits, as the released funds might be taken into consideration income or funding

Report this page